Andre Soelistyo, chief executive of Indonesian super app and ecommerce platform provider GoTo, appeared humbled by the more than 50 per cent increase in its net loss in 2022, calling the period “challenging” and an “inflection point” for the company, which has struggled to turn a profit.

“It was a year that changed our thinking and showed us how we needed to operate,” Soelistyo said at a news conference last month announcing the company’s annual results.

GoTo’s brutal bottom line revealed that its 12-month net loss had widened 56 per cent to Rp40.4tn ($2.7bn) from 2021. The company’s burgeoning red ink is now more than three times the size of its revenue, despite the latter doubling over the past year to Rp11.3tn.

To make matters worse, its peers in the south-east Asian tech sphere — fellow Indonesian ecommerce company Bukalapak and Singapore’s Grab and Sea — are emerging from their own profitability funk, even as GoTo sinks deeper into losses.

Investors, perhaps not surprisingly, have grown wary of GoTo, which was formed to much fanfare in May 2021 through the merger of ride-hailing and food delivery company Gojek and local ecommerce leader Tokopedia in the largest merger in Indonesia’s corporate history. Both companies were high-profile unicorns — start-ups valued at more than $1bn.

But since listing on the Indonesia Stock Exchange on April 11 last year, GoTo’s shares have slumped, closing at Rp99 one year later on Tuesday, less than a third of their ambitious initial public offering price of Rp338. GoTo’s market capitalisation now stands at Rp104tn according to S&P Capital IQ, making it the 14th largest on the IDX.

This article is from Nikkei Asia, a global publication with a uniquely Asian perspective on politics, the economy, business and international affairs. Our own correspondents and outside commentators from around the world share their views on Asia, while our Asia300 section provides in-depth coverage of 300 of the biggest and fastest-growing listed companies from 11 economies outside Japan.

Subscribe | Group subscriptions

“For GoTo, I would say the biggest thing they have working against them would be unfortunate timing,” Piter Abdullah, executive director at Jakarta-based Segara Research Institute, told Nikkei Asia. “The company listed just as the market was turning against the sector and demanding profitability, rather than rapid growth.”

Despite the mounting losses, Soelistyo sees positive signs. “We have made considerable progress on our accelerated path to profitability,” he said in a statement accompanying the earnings announcement, seizing on GoTo’s fourth straight quarter of improved adjusted earnings before interest, taxes, depreciation and amortisation in the final three months of last year.

The company says it is making headway in reducing costs. It said it reduced incentives and product marketing by 34 per cent to Rp2.8tn during the October to December quarter last year from the same period the year before.

But analysts say the challenges go beyond a need for financial pruning, and that the company needs to become more competitive and improve its fundamentals to start making money.

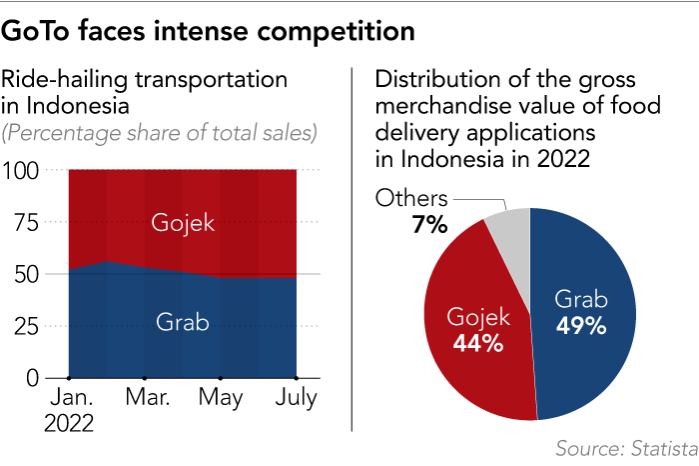

“GoTo has announced they would bring forward profitability targets, but they are facing a really challenging capital and competitive environment,” said Jianggan Li, chief executive of Momentum Works, a Singapore-based consultancy. “The real challenge is they are competing on so many fronts with larger regional competitors who also have better cash positions.”

GoTo attributed the bigger net loss to several factors, including an Rp11tn goodwill impairment related to the merger of Gojek and Tokopedia, which remain group units.

GoTo also cited an increase in share-based compensation expenses due to an adjustment of the assumed employee turnover rate to reflect the latest historical trend and one-off restructuring costs, or expenses incurred when a company reorganises operations, among other things.

“We think one of the biggest parts of this expense came from salary of the employee[s] and includes employee lay-off cost[s] that [were] conducted in 2022,” said Josua Pardede, an economist at Bank Permata. “Going forward, as GoTo started to make their operational activities more efficient through some lay-off[s], we expect the non-variable expense, especially on employee salary, will decline and support GoTo’s profitability, going forward.”

GoTo is not alone in facing profitability and other challenges. But other regional tech companies are making progress, including through reducing staff.

Sea last month reported its first quarterly profit since going public five years ago as restructuring efforts that included cutting thousands of jobs and freezing salaries started to pay off. Bukalapak booked its first profit in 2022, though it came largely as a result of a marked-to-market gain from its investment in local lender, Allo Bank. And Grab now expects to break even as a group in the final quarter of 2023 on an adjusted ebitda basis, after narrowing its annual loss to $1.74bn in 2022, a 51 per cent improvement from a year earlier.

GoTo is also stepping up reductions in its headcount, announcing last month an additional 600 lay-offs, after saying in November that it would trim its labour force by 1,300 employees, or 12 per cent. The company said the most recent job cuts were needed to “create a more streamlined organisation”.

Analysts welcome that, but say its is only part of the solution. “Just job cuts will not be enough,” said Li of Momentum Works, although he stressed that they must accelerate. He said action was required on multiple fronts, including cuts to non-core activities, emphasis on increased efficiency and bottom-line improvements by managers of business units, and divestments from markets such as Vietnam, where continuing was not viable in the near or medium term. “To achieve net profit, they will need more drastic measures to squeeze efficiency and cost savings in all areas of operations,” Li said.

Reza Priyambada, a senior researcher at CSA Research Institute, sees no need for a management shake-up. He prefers that the current line-up “keep focus on how to manage the cost[s]” and work on increasing revenue through innovation.

Spending too much on promotions was “good for [the] customer, but bad for [the] company,” Priyambada said.

A version of this article was first published by Nikkei Asia on April 7 2023. ©2023 Nikkei Inc. All rights reserved.

Related Stories